To reclaim a repossessed vehicle due to a car title loan, gather essential documents including the original title, ID, insurance, and payment receipts. Understand default reasons, resolve financial issues, pay off the outstanding balance, and prepare for vehicle inspection to assess condition and resale value. This process is crucial for successful reinstatement and future financing options.

Looking to reclaim your vehicle after a car title loan repossession? This guide breaks down the essential steps and documents needed for car title loan reinstatement. Understanding the requirements is crucial before attempting to regain ownership of your repossessed vehicle. We’ll walk you through gathering necessary papers, from identification and proof of insurance to financial records, ensuring a smooth process. Learn how to restore ownership after repossession and take control again.

- Understanding Car Title Loan Reinstatement Requirements

- Gather Necessary Documents for Repossed Vehicle

- Restoring Ownership After Car Repossession

Understanding Car Title Loan Reinstatement Requirements

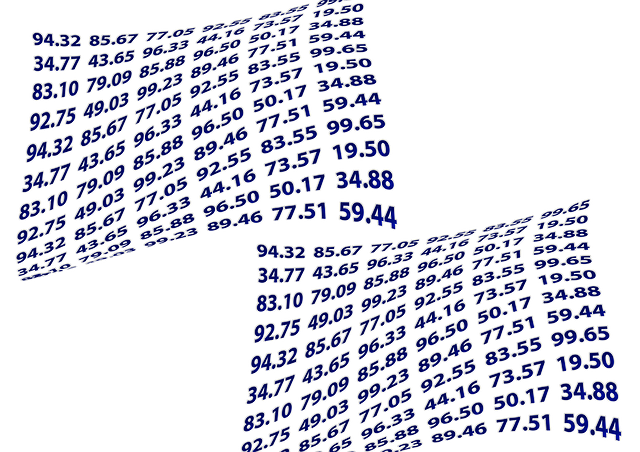

When considering car title loan reinstatement after repossession, understanding the requirements is crucial. The process involves gathering specific documents to demonstrate your ability to repay the loan and regain ownership of your vehicle. Lenders typically demand proof of income, valid identification, and a clear plan for repayment, among other things. Having these in order can expedite the reinstatement process significantly.

In Dallas Title Loans, quick funding is often available for those who qualify. Even with bad credit loans, meeting these basic requirements can increase your chances of successfully reinstating your car title loan. Remember, timely communication with your lender and proactive steps towards repayment are essential elements in navigating this process smoothly.

Gather Necessary Documents for Repossed Vehicle

When your vehicle is repossessed due to non-payment of a car title loan, the path to reinstating ownership involves gathering specific documents. These papers are essential for proving your identity and right to reclaim your vehicle. Key among them is the original vehicle title, which should be in your name and free from any liens or encumbrances other than the existing loan.

Additionally, expect to provide a valid government-issued photo ID, such as a driver’s license or passport, along with proof of insurance for the vehicle. If you have made any payments towards the loan, collecting receipts can help demonstrate your commitment to repaying the debt and may enhance your loan eligibility, even with bad credit. These documents are crucial steps in the process of car title loan reinstatement after repossession.

Restoring Ownership After Car Repossession

After a car has been repossessed due to an outstanding car title loan, the first step towards reinstatement is to regain ownership. This process begins with understanding why the vehicle was taken back by the lender. If the borrower has defaulted on payments or failed to meet the loan terms, they must rectify these issues. One of the primary goals during this period is to demonstrate financial stability and a commitment to meeting all future obligations.

Restoring ownership involves fulfilling any outstanding loan balance plus additional fees and charges as per the loan agreement. Borrowers should also be prepared for a thorough vehicle inspection to assess its current condition. This step is crucial in determining the car’s resale value, which can impact the loan reinstatement process and the terms of future financing options, including quick funding solutions.

Car title loan reinstatement after repossession involves a clear understanding of the required documents and processes. By gathering essential paperwork, such as identification, proof of insurance, and a reinstatement application, individuals can work towards regaining ownership of their vehicles. Following the outlined steps, including restoration procedures and fulfilling all legal obligations, allows for a successful car title loan reinstatement process.